Building an ESG awareness

This blog post was written by Mark Wearden, an experienced NED, a nationally recognised authority on corporate governance, a prolific author, and an outstanding trainer and mentor.

There continues to be a global drive towards the need for a wider Corporate Social Responsibility awareness within every type, size and shape of organisation. This is now linked intrinsically with the acronym ESG – Environmental, Social and Governance.

The acronym, and an ESG approach, are becoming encompassed within many aspects of the life of an organisation. It is only through the organisational reporting that stakeholders will be able to form a serious judgement as to the efficacy of the ESG approach within an organisation, or whether it is being used as a formulaic or tick-box sop to a wider CSR (corporate and social responsibility) agenda. Of course, when viewed from the inside of an organisation we can often perceive this dichotomy and determine whether there is a genuine approach to CSR.

CSR is the structure within which we all operate. Whatever the formal structure of our organisation, we are accountable to a wide range of stakeholders. We need to be able to understand the impact that our organisational decisions will have on the world and its people.

- The ethical norms and behaviour that can or cannot be expected from any organisation, and then, at a deeper level, the behaviours that can be rightly expected from any particular organisation, within its own sector and context.

- The manner in which employees of the organisation are treated.

- The ethics and ethos which pervades the organisation – ethics being the behavioural traits that are visible, and ethos being the ethical stance being taken by those who structure and oversee the culture within an organisation.

It is often assumed that these CSR expectations are relatively recent, but a 1987 report from the World Commission on Environment and Development entitled ‘Our Common Future’, known as the Brundtland Report, explored a breadth of guiding principles for sustainable development within organisations.

The introduction of a stakeholder awareness duty in CA 2006 section 172 started a different type of UK focus on a wider accountability than simply to the underlying members of a company. The introduction of section 414CZA to CA2006 in 2018 requires directors of all large companies (under CA2006) to now include a focused statement describing how the directors have met their wider stakeholder expectations:

“A strategic report for a financial year of a company must include a statement (a “section 172(1) statement”) which describes how the directors have had regard to the matters set out in section 172(1)(a) to (f) when performing their duty under section 172.”

The introduction of the enhanced transparency required by this legal expectation can be seen to have arisen from wider stakeholder expectations aligned with the growth of a high societal profiling of environmental issues, not least climate change.

Every week media reports identify calls from investors for enhanced ESG reporting and accountability. The global drive towards more enhanced and transparent stakeholder reporting has become encompassed within many aspects of the life of an organisation. The perception being that through enhanced narrative dimensions of corporate reporting stakeholders will be able to make better and more informed judgements on organisations.

The journey towards a wider stakeholder economy requires us to find acceptable ways of measuring more than just the tangibles of the corporate equation. In January 2020 at the World Economic Forum in Davos, a paper was published, in collaboration with the four major accounting firms, entitled:

“Towards Common Metrics and Consistent Reporting of Sustainable Value Creation”

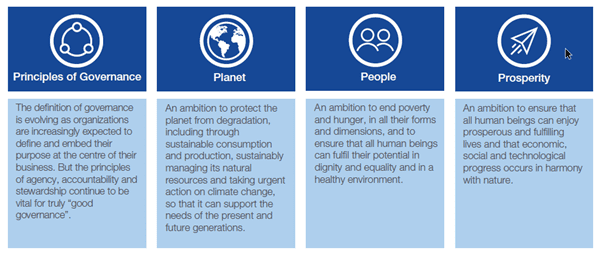

At its heart it has four pillars:

It is suggested in the paper that these should be used as the basis for effective ESG consideration and reporting. The paper does recognise the need for real-world sense checks.

- materiality – does our thinking have any real impact ?

- actionability/feasibility – can idealistic thinking be turned into practical reality?

The UK corporate regulator – The Financial Reporting Council suggest that investors would like companies to articulate more clearly and with greater transparency:

- how boards consider and assess the topic of climate change;

- whether, and how, the business model may be affected by climate change, whether it remains sustainable, and how the company may respond to the challenge posed by climate change;

- what the opportunities and risks are, including the prioritisation of risks and their likelihood and impact;

- what changes the company might need to make to strategy to capitalise on a changing climate and related opportunities;

- what scenarios might affect the company’s sustainability and viability, and how;

- how the impact is measured and how the company measures the climate-related challenges and the success of its strategy through strategically aligned, reliable, transparent metrics and financially relevant information.

Actions for directors

Recent headlines have identified an increasing focus within the media on the accountability of directors and the need for a company to demonstrate their ESG focus and readiness. Interestingly this has also formed part of candidate’s questions about a company as a potential employer at the majority of interviews that I have carried out for clients over the past couple of years.

This cannot be ignored. It will increasingly become a core part of our corporate conscience.

The questions to be asked within the company are:

- who sets the tone?

- who captures the data?

- who refines the data?

- who measures the impact?

- who writes the report?

- who listens for response?

NB – just for reference in case you see the acronym TCFD.

The Task Force on Climate-related Financial Disclosures (TCFD) was established by The Financial Stability Board to develop recommendations for more effective climate-related disclosures that could promote more informed investment, credit, and insurance underwriting decisions and, in turn, enable stakeholders to understand better the concentrations of carbon-related assets in the financial sector and the financial system’s exposures to climate-related risks. The Task Force is charged with considering “the physical, liability and transition risks associated with climate change and what constitutes effective financial disclosures across industries.

The UK Government Green Finance Strategy issued in June 2019 aligned itself with the objectives of the TCFD and declared an expectation that by 2025 all UK large companies will be expected to follow the TCFD guidelines around reporting. Their disclosure recommendations are structured around four thematic areas that represent core elements of how organizations operate: governance, strategy, risk management, and metrics and targets. These thematic areas are intended to interlink and inform each other.

The Boardroom Effectiveness Company offers a wide range of training, coaching and consultancy services aimed at helping boards be more effective. Take a look at our full range of services or give us a call on 01582 463465 – we’re always happy to help.

Mark Wearden is an experienced NED, a nationally recognised authority on corporate governance, a prolific author, and an outstanding trainer and mentor.