Risk appetite and risk tolerance

Before you read through this article, just pause for a moment and consider the significance of the simple four-letter word ‘RISK’ and its immediate and powerful meaning to the human brain.

The concept and consideration of risk can take a person from a predetermined path and lead him or her to behave in a manner that had previously seemed unlikely.

The image of a tightrope walker is used as an analogy for much of what we face throughout our daily lives – a strategic journey across a chasm fraught with risk.

- How do we get from point A to point B?

- Do we have the courage to take the first step?

- How will we feel when we are halfway across?

- What outcomes are we expecting?

- What would be your approach to such risk?

- What is the view of the crowd?

We need to think further about we really mean by the term ‘RISK’ and be able to recognise how we as individuals, and as organisations (collections of individuals), are prepared and able to take the same level of perceived risk as the tightrope walker.

To be academically precise about this, the word ‘risk’ refers to a range of understandable and quantifiable outcomes, whereas the word ‘uncertainty’ suggests that although we can perceive a variety of outcomes, they are not quantifiable.

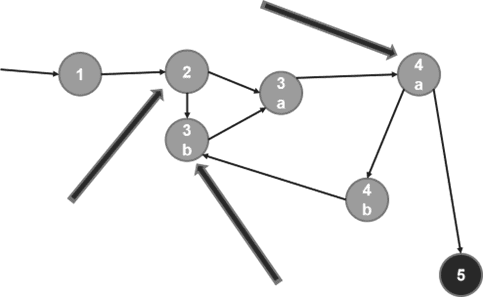

We need to recognise that daily we will be faced with situations where there are a number of potential directions (strategic outcomes or possible routes) that will still enable us to achieve the same perceived strategic goal. These can often include numerous iterations as illustrated below, where the only points of absolute certainty are points 1 and 3a.

We need to understand the consequences of the decisions that we make at the various points of risk along the strategic journey from A to B, or 1 to 5 in the different images.

- What could put us out of business today, or tomorrow? (Tangible and fatal damage)

- What headlines would we least lie to see in the media? (Intangible and reputational damage – also potentially fatal)

- How do we stop too many iterations around 2 and 3, or around 3 and 4?

- Do we understand the real drivers that enable the final move from 4a to 5?

These are human considerations but in business jargon the word ‘risk’ is often followed by a further dimension and these differentiations are important.

Risk appetite is based around the perpetual pull in the human mind between risk aversion and risk seeking.

- A risk-averse person (or group of people) looks for certainty of outcome and is therefore prepared to sacrifice opportunities that might exist for change. Risk aversion can often lead to an intolerance of challenge and therefore an overreaction to any threat to the status quo. Facts are often preferred to theories; strategic breadth will be restricted.

- A risk-seeking person (or group of people) accepts that life is full of options and uncertainty and such a person has confidence in using their abilities to counter whatever they may face. Threats that are seen by the risk-averse person are very often not even considered as threats by the risk-seeking person. Risk seeking can often lead to a dangerous dismissal of the realities that confront a person or organisation. Imagination is often preferred to facts; strategic breadth will be wide.

Risk capacity is the maximum level of risk that can be taken, and often that is required to be taken to achieve the intended strategic goals, but also might describe the difference between actual risk being taken and the higher or lower levels of tolerance.

Risk tolerance is required in the real world by both risk-averters and risk-seekers. It emerges from a different perspective to risk appetite and is best illustrated in the type of ‘bubble chart’ used by many organisations to consider their risk profile. Acceptable levels of tolerance are measured from the interaction of relative impact and relative likelihood and in most organisations (or people) there will be natural clusters of acceptability together with aspects that would be unacceptable in the case of a high:high result and would not be worth the effort in the case of a low:low result

Risk positioning requires an understanding of where the risk exists. Of course, this can only be now or in the future. We have already faced the risks of the past – too many board and committee meetings spend time trying to think about how to avoid risks that have already occurred, instead of focusing on strategic risk.

- Past

- What has been learned from the risks faced in the past?

- What has been achieved by overcoming or mitigating those risks?

- How has the organisation measured and recorded these risk activities?

- Present

- What are the organisation values today?

- What are the driving forces of risk that threaten today and its values?

- How well is that vulnerability understood by directors, particularly in terms of viability?

- Future

- What needs to change and how is it being tackled?

- Are the change timeframes realistic?

- Do the directors understand how successful risk mitigation will be recognised, or is there just a permanent state of risk?

Risk intelligence

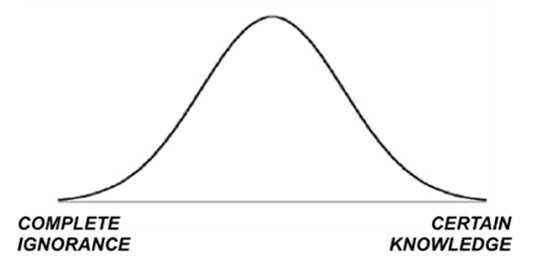

In his book 2012 book Risk Intelligence, Dylan Evans suggests that anyone involved in the assessment of risk (and that is all of us in our everyday lives) must develop the ability to gauge the limits of our own knowledge; to recognise the difference between our caution when we lack sufficient information to make a judgement, and our confidence when we believe we do. This helps to establish the parameters of our tolerance.

He further suggests that the concept of “risk intelligence” operates in the area that exists between certain knowledge and complete ignorance, and that it is our job to find our place along this momentum for each and every risk scenario that we face. If we apply standard deviation to this concept we would be able to identify our mean point and through the Gaussian curve effect recognise the extent of the potential outcomes.

Take a moment and think about how you and your organisation might measure against these risk criteria – appetite, capacity, tolerance, positioning, intelligence.

The Boardroom Effectiveness Company offers a wide range of training, coaching and consultancy services aimed at helping boards be more effective. Take a look at our full range of services or give us a call on 01582 463465 – we’re always happy to help.