Strategic thinking

This blog past was written by Mark Wearden, an experienced NED, a nationally recognised authority on corporate governance, a prolific author, and an outstanding trainer and mentor.

Strategic thinking requires the visioning of the unknown beyond the certainties of the known. This requires us to move cerebrally beyond our current clarity and understanding and contemplate uncertain and potential forward outcomes. The near future is more readily imaginable than the more distant future, and hence an inevitable human focus on short term thinking. But strategy in the context of financial and organisational sustainability may well require a longer perspective and hence the changing emphasis from regulators and others from accepting a simple concept of going-concern to requiring an explanation of longer-term viability.

In his1999 book ‘The Living Company’ Arie de Geus suggests that all too often “managers forget that their organisation’s true nature is that of a community of humans”. Such concepts of organisational evolution have often failed to impact the focus of boards and committees, with their concentration on facts and figures, rather than a consideration of the behavioural drivers which reside beneath the surface. Strategic thinking, by its very nature, can only ever be the result of the imagination of one or more human brains.

In today’s world of technology, and with an increasing reliance on, and exploration of artificial intelligence, it would be easy to consider that human future perception is being replaced. We have to remember, however, that until now, even technological ‘intelligence’ is based around algorithms derived from human brains. If, in the future, the realisation of strategic objectives is dependent upon machine thinking, then we may have to consider a much wider range of potential problems. The frequent, short-term volatility of stock markets is evidence of the risk averseness of immediate reaction, when the minutest change in prices can create a machine-based herd reaction, based upon those very algorithms that have been written by the supposedly logical brains of humans.

The making of TODAY and the uncertainty of the FUTURE

Today can be defined at the micro level as a precise moment in time; in accounting terms this could well be the financial reporting, or balance sheet date.

At this point there is certainty; it is possible to analyse the realities of such a ‘today’ position, and to interpret the rationale of the position by considering the events from the past that have led to this frozen moment of time. The preparation of a year-end balance sheet, with its alignment to the income, profitability and cashflow movements in the previous 12 months is exactly what accountants do across all organisations.

Anything and everything beyond such a point is speculative.

If the future is considered from a realistic perspective, then there is very little that can be stated with certainty other than events of nature such as that planetary movement will cause it to go dark later today, and then light from the sun will appear again tomorrow.

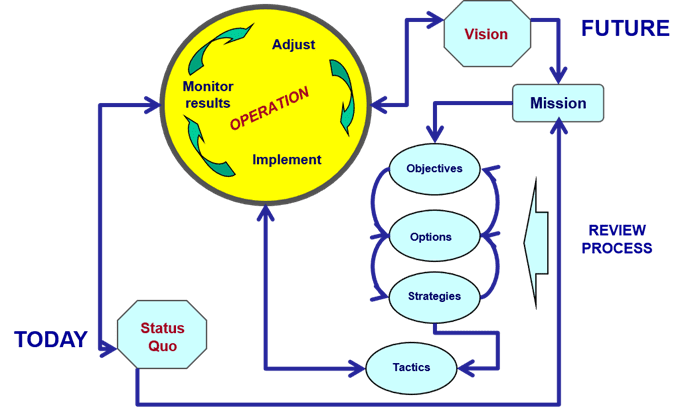

The third dimension of the model is how to move from TODAY to the FUTURE. The model illustrates a simple straight-line connection across the base.

At this level of consideration, this is the best we can do, we know that TODAY and FUTURE are linked but the route is not yet determined. We can only visualise how we move across the chasm, but we need to realise that to make that move we have to have a more defined clarity about where we are starting from and where we hope we are heading.

RISK is an inevitable consequence of viewing the world from a model such as this. The minute we leave the safety of the TODAY position, and head towards the FUTURE, we are surrounded by risk. The only certainty that we have in life at any point is TODAY.

Of course, the fixing of the TODAY point is only to secure a determined reference point from which to start. In our strategic financial thinking, the reality of TODAY is that it is a constantly moving dimension of time.

Benchmarks along the route

In our strategic thinking the best we can hope for is to establish benchmarks to help us in our visualisation of how to achieve the future, and to then further challenge our considerations as we actually work into that future. The classic five-year plan falls into this category, but all too often directors and managers fail to revisit the changed starting point (the new Today) as they progress through the plan. The Covid pandemic has forced many businesses to seriously reconsider their ‘today’ position on a far more regular basis.

How we forecast and build these benchmarks can be a pure statistical or numeric exercise, but ought always to include some aspect of behaviour and bias recognition

- Single point forecasting: the focus being one single figure or result; this is where we are able to forecast with a degree of certainty both a starting point and the route from today to a future defined end point.

- Range forecasting: the focus being a range of possibilities; this is where there is a relatively high level of risk involved along the route, the diversity of end-point possibilities will be determined by the levels of risk that we perceive at the today; sometimes we are also able to assign probabilities to the potential outcomes.

- Alternative futures forecasting: the focus being a defined number of potential fixed-point outcomes; this will be where we recognise there are a recognisable range of likely results from our strategy, but that the end result will be dependent upon decisions or events along the route.

To use single point forecasting an organisation needs to have significant confidence about the future, but even this will be based around certain starting parameters which may in reality change across the passage of time.

In any other form of forecasting we are required to consider a range of different scenarios, and therefore potentially the interaction of a complexity of changing parameters. One of the problems with the flexibility of today’s technology, and the use of a spreadsheet such as Excel, is that we are able to provide an apparently coherent set of forecasts with relative ease.

Now consider the fuller ‘today – future’ model. There is very good reason to ensure that the iterations on the right-hand side are frequent and challenging.

We need to have a structure for the iterations on the right-hand side of this model. A useful set of dimensions was developed by in 2014 by Gill Ringland to challenge the strategist and contemplate what really matters within a particular organisation. In this following table, I have aligned Ringland’s dimensions with the type of question that a strategic thinker ought to be asking, together with some ‘trigger’ words which should be in the mind of the thinker.

| DIMENSION | QUESTIONS | TRIGGER WORDS |

| Vital issues | What is critical for the future as we currently perceive it? | DATA &

KNOWLEDGE |

| Positive outcome | What does the best possible outcome look like?

What difference would it make? |

UTOPIAN

IMPACT |

| Negative outcome | What does the worst possible outcome look like?

What difference would it make? |

DISTOPIAN

IMPACT |

| Internal systems | What are the culture, structure and process drivers within the organisation?

What might need to change? |

REALITY

& OBSTACLES |

| Key learnings | What have we learned from previous strategies? | EXPERIENCE |

| Key decisions | What are the urgent actions needed to begin the process of strategic change? | IMMEDIACY |

| Personal dimension | What would I like to influence to make a real difference?

What can I do to make a real difference? |

EGO & REALITY |

The Boardroom Effectiveness Company offers a wide range of training, coaching and consultancy services aimed at helping boards be more effective. Take a look at our full range of services or give us a call on 01582 463465 – we’re always happy to help.